Renters Insurance in and around Hollywood

Renters of Hollywood, State Farm can cover you

Your belongings say p-lease and thank you to renters insurance

Would you like to create a personalized renters quote?

Home Sweet Home Starts With State Farm

It may feel like a lot to think through work, your busy schedule, family events, as well as coverage options and deductibles for renters insurance. State Farm offers no-nonsense assistance and impressive coverage for your appliances, tools and cameras in your rented property. When the unexpected happens, State Farm can help.

Renters of Hollywood, State Farm can cover you

Your belongings say p-lease and thank you to renters insurance

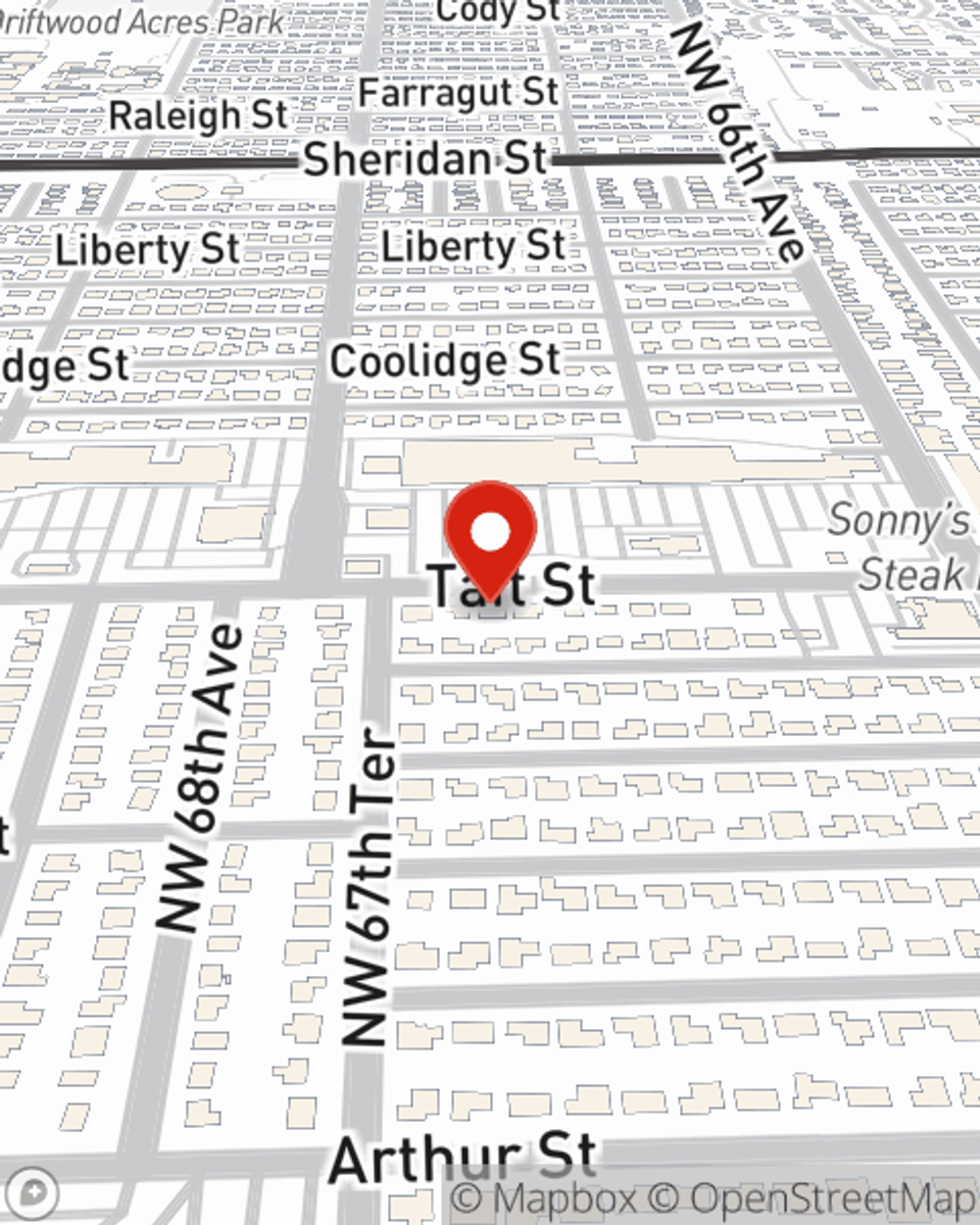

Agent Sara Stevenson, At Your Service

You may be doubtful that Renters insurance can help you, but what many renters don't know is that your landlord's insurance generally only covers the structure of the condo. The cost of replacing your belongings can be substantial. With State Farm's Renters insurance, you have a good neighbor who can help when fires or break-ins occur.

If you're looking for a committed provider that can help you protect your belongings and save, visit State Farm agent Sara Stevenson today.

Have More Questions About Renters Insurance?

Call Sara at (954) 989-8719 or visit our FAQ page.

Simple Insights®

Answers about automatic fire sprinkler systems

Answers about automatic fire sprinkler systems

Commercial sprinkler systems are a key step in fire protection. If you have questions, get answers to help protect your business from devastating fire damage.

Checklist for apartment renting

Checklist for apartment renting

When finding an apartment, it’s important to know what to look for so you can make a smart assessment about each property you’re interested in.

Sara Stevenson

State Farm® Insurance AgentSimple Insights®

Answers about automatic fire sprinkler systems

Answers about automatic fire sprinkler systems

Commercial sprinkler systems are a key step in fire protection. If you have questions, get answers to help protect your business from devastating fire damage.

Checklist for apartment renting

Checklist for apartment renting

When finding an apartment, it’s important to know what to look for so you can make a smart assessment about each property you’re interested in.